Countries With the Highest Corporate Taxes

Corporate tax, also known as company tax, income tax, or capital tax, refers to income to the government from a trading entity or company. When a trading corporation is set, it aims at making profits. The net profit made after deducting the cost of operation and overheads is charged a certain percentage which is remitted to the government. This legal obligation of the corporation to the state is calculated and paid before dividends are paid to shareholders. It can be levied by the central government or state authorities depending on the governing structure. Some categories of corporations can be exempted.

Corporate Tax Rates Around The World

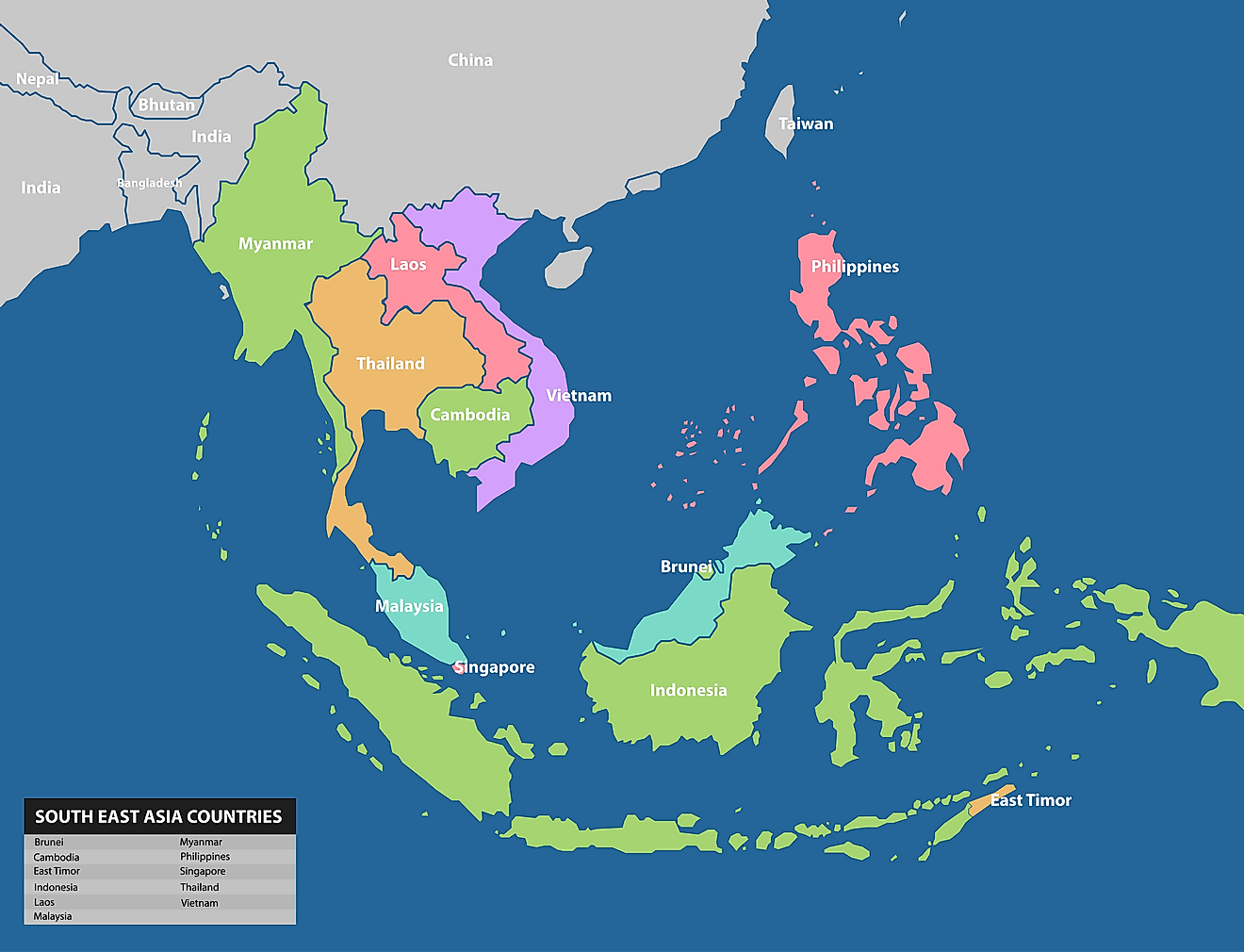

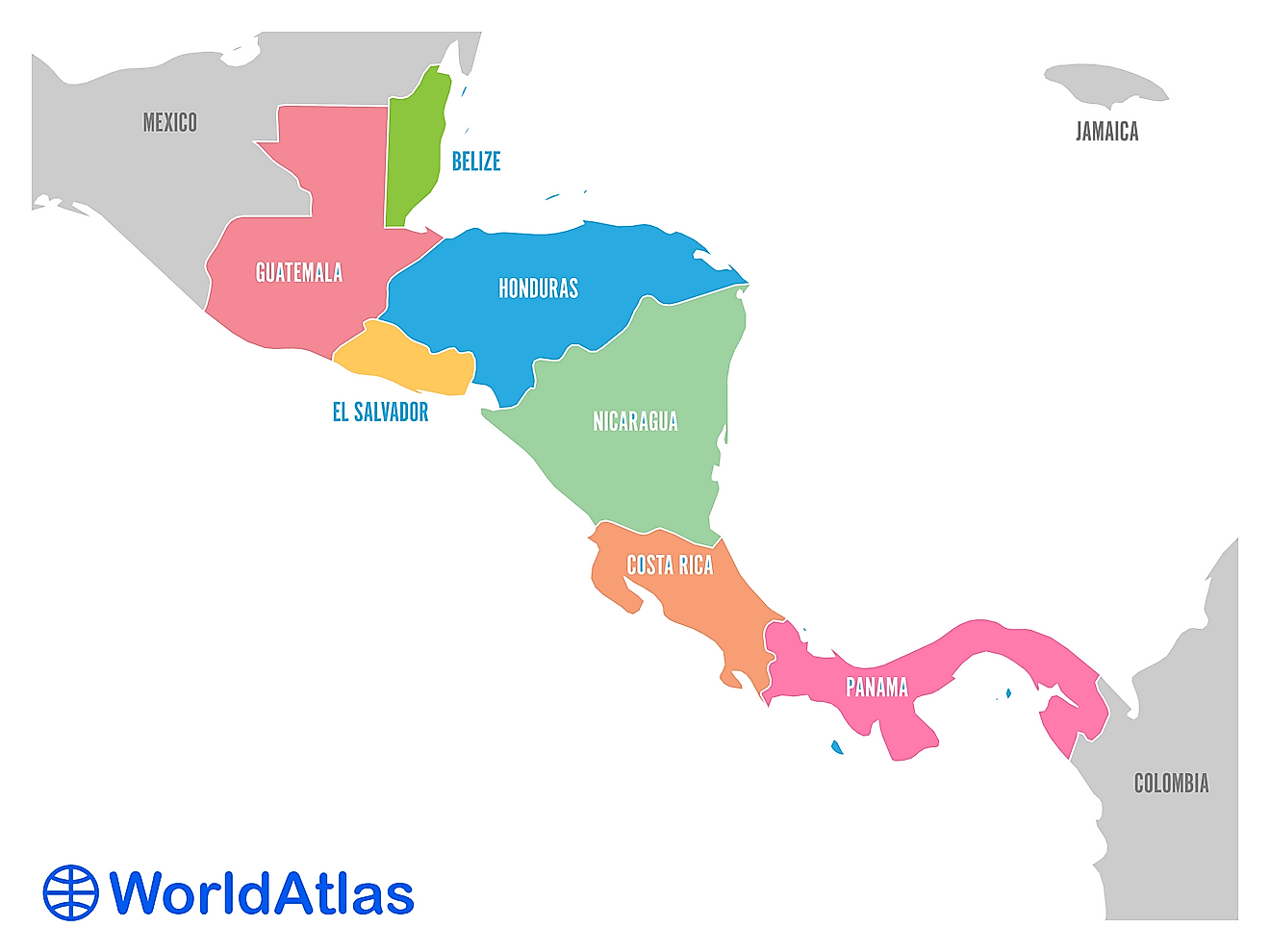

Corporate tax levies differ from nation to nation with the United Arab Emirates topping the list of countries with the highest corporate tax at 55%. The tax is levied on both locally incorporated companies as well as foreign investors unless if the company operates in the free trade zones. Bangladesh comes second with a rate of 35% on non-listed corporations. Nevertheless, special categories are taxed higher such as financial institutions and cigarette making companies which are charged 40% and 45% respectively.

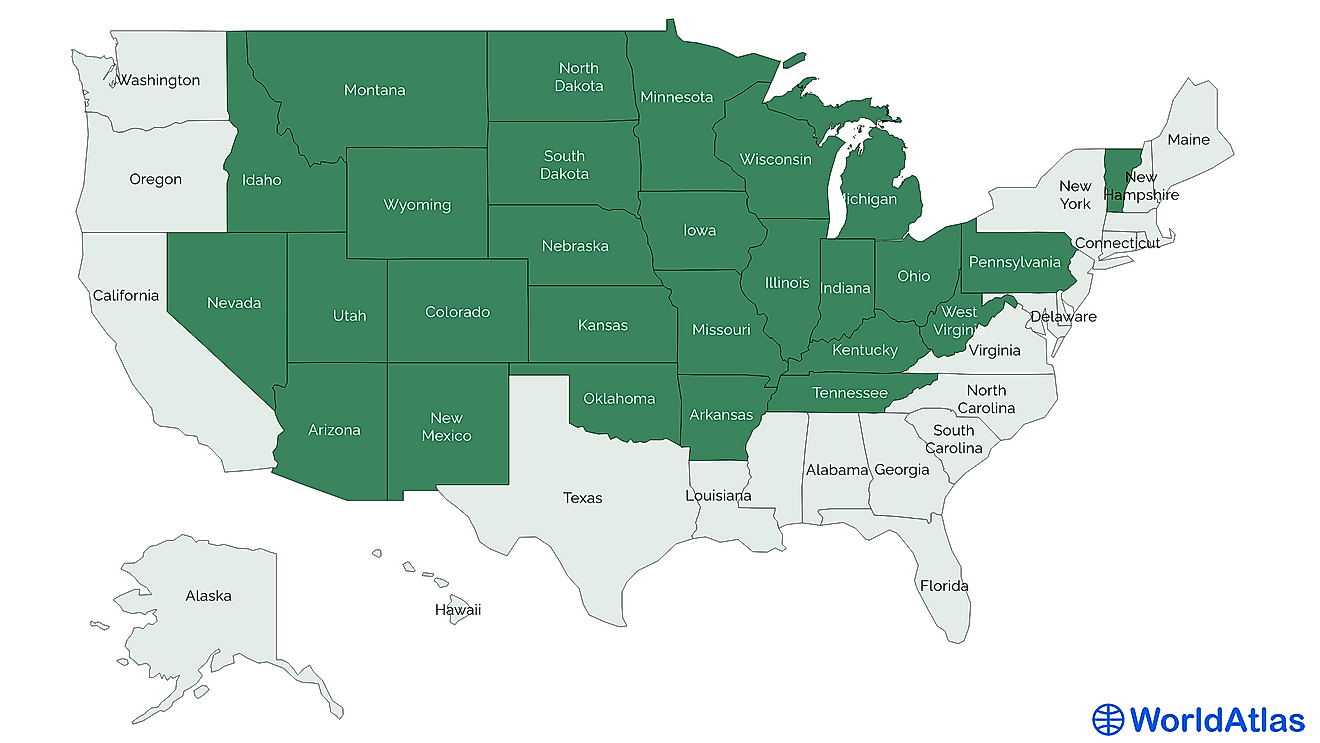

The United States, Burundi, Gabon, Pakistan, Argentina, Zambia, and Benin charge a corporate tax rate of 35%. The US, which is the biggest economy charging this high rate, has seen various tax reviews made to integrate various states tax requirements. The US has also segmented taxation depending on the income level of a corporation with those earning lower incomes taxed at 15% on the first $50,000 and 35% on net profit above $10,000,000. The third world economies such as Burundi, Benin, Gabon, and Zambia have been encouraged to lower the rates to attract foreign investors.

Brazil and Venezuela charge a corporate tax of 34% of the net profit while Lithuania, Monaco, Belgium, and Jamaica charge a corporate tax of an average of 33%. Japan and Cameroon are slightly below at 32.11% and 31.5% respectively. Canada and the Central Africa Republic charge 31% and 30% respectively. There are other countries with very low corporate taxes such as The United Kingdom and Hungary at 19%, Singapore at 17%, and Ireland at 12%.

Effects of High Corporate Taxes

The major advantage of charging high corporate tax is that the government will be able to meet its obligations to the citizens such as the provision of infrastructures and other amenities. However, this is possible if the taxes are duly collected and properly utilized.

The negative effect is that high taxes make the corporation raise the cost of their products affecting those in the bottom of the pyramid. High marginal taxation takes away money that could have otherwise been used on staff welfare, leading to laying offs of staff or the company relocating to a country with a lower tax rate. The net effect is product discontinuation and unemployment.

Countries With the Highest Corporate Taxes

| Rank | Country | Corporate Tax Rate (Percentage) |

|---|---|---|

| 1 | United Arab Emirates | 55 |

| 2 | Bangladesh | 35 |

| 3 | Burundi | 35 |

| 4 | United States | 35 |

| 5 | Gabon | 35 |

| 6 | Pakistan | 35 |

| 7 | Argentina | 35 |

| 8 | Benin | 35 |

| 9 | Zambia | 35 |

| 10 | Brazil | 34 |

| 11 | Venezuela | 34 |

| 12 | Belgium | 33.99 |

| 13 | Lithuania | 33.75 |

| 14 | Monaco | 33.33 |

| 15 | Jamaica | 33.3 |

| 16 | Japan | 32.11 |

| 17 | Cameroon | 31.5 |

| 18 | Gambia | 31 |

| 19 | Canada | 31 |

| 20 | Central African Republic | 30 |