The Largest Banks in the United Kingdom

The banking sector in the UK went through a period of consolidation following the financial crisis. Some banks including Halifax Bank of Scotland and Lloyds TBS merged to create one bigg banking group. The banking sector is dominated mainly by the few large banks. The large banks operate a complex monopolistic supply of services to SMEs which has led to reduced level of competition. In the UK, there is no major stratum for the independent local banks. Below are the five biggest banks in the United Kingdom.

The UK's Largest Banks

HSBC Holdings

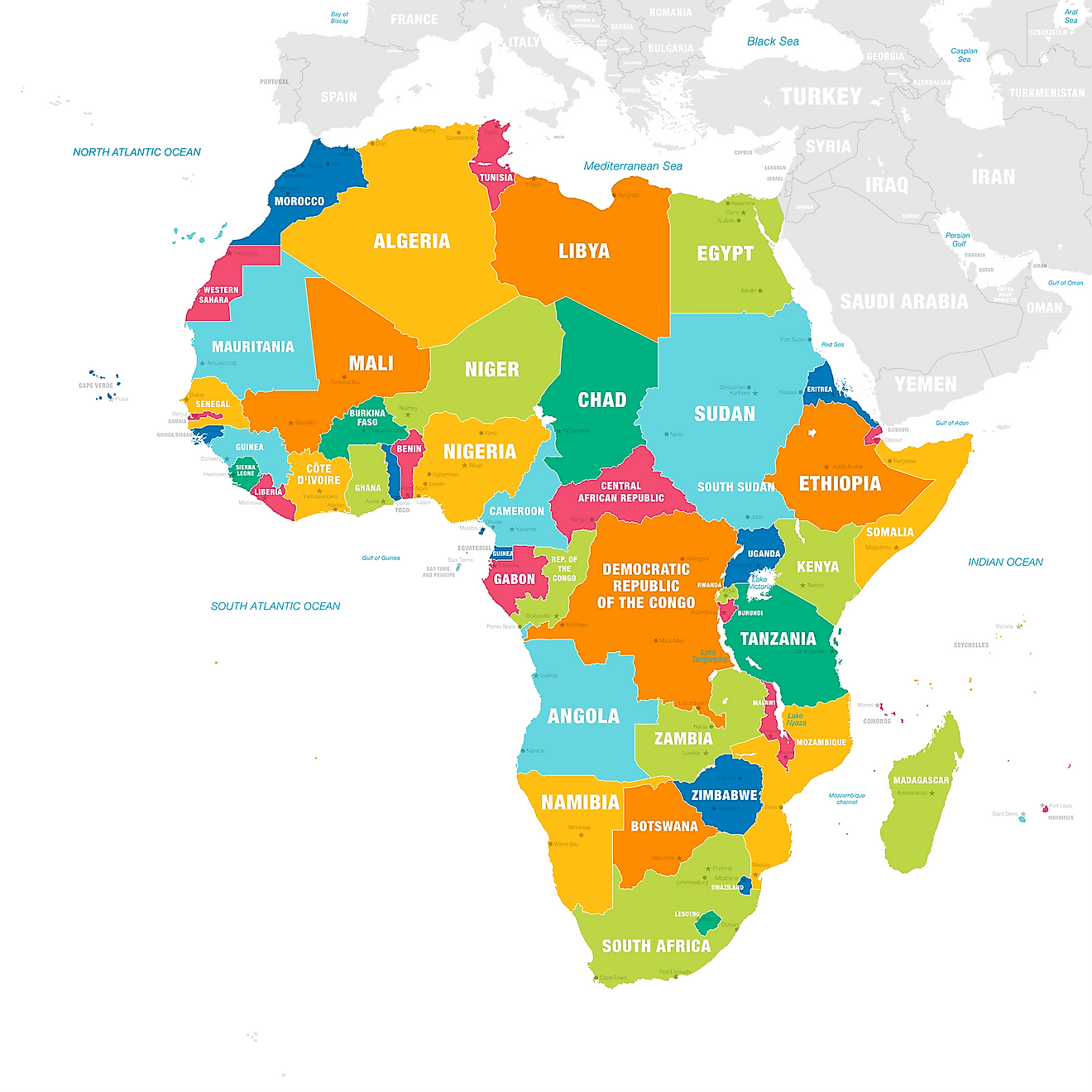

The largest bank in the UK by the asset is the HSBC Holdings Plc. It is also the 7th largest bank and the largest in Europe by an asset with a total asset of 1,936 billion pounds. It was first established in March 1865 in British Hong Kong and established in London in 1991. HSBC Holdings boasts of 3,900 offices in 67 countries across Asia, Africa, Europe, Americas, and Oceania. The name HSBC is derived from the initials of the bank’s name at inception, Hong Kong and Shanghai Banking Corporation. It is organized into four major business groups; Global and Global Private Banking, Commercial Banking, and Retail Banking.

Lloyds Banking Group

Lloyds Banking Group was established through the merger of HBOS and Lloyds TBS in 2009. The group is headquartered in Gresham Street in London. With an asset of 817 billion pounds, Lloyds Banking Group is the second largest bank in the UK. It has extensive operations in several countries in Europe, Asia, Middle East, and the US. The group is organized into retail, commercial banking, insurance, and consumer finance. It has approximately 75,000 employees working in its various offices.

Royal Bank of Scotland Group

Popularly referred to as RBS Group, the Royal Bank of Scotland Group is a holding company that offers a wide range of banking services such as personal and business banking, insurance, and corporate finance. The group is headquartered in Edinburgh, Scotland and has other offices in Europe, Asia, and North America. With an asset of £783 billion, the RBS Group is the third largest bank in the UK. It issues banknotes in Northern Ireland and Scotland and is the only bank in the UK that still prints £1 note.

Barclays

Barclays is a multinational bank headquartered in London and has a global reach. The bank offers products and services across wealth management, corporate and personal banking, and insurance. Barclays operates in 40 countries and has over 120,000 employees. The bank traces its origin in 1690 at a goldsmith banking business in London and quickly spread to become a nationwide bank. It was the first bank to deploy the first cash dispenser. Its assets are valued at £1,203 billion.

Standard Chartered

Standard Chartered is based in London and operates a network of over 1,200 branches across at least 70 countries, employing over 87,000 people. Although it is based in the UK, the bank does not operate retail banking there. About 90% of its profit comes from Africa, Asia, and the Middle East. Its biggest shareholder is the Temasek Holdings which is owned by the Government of Singapore. The bank’s assets are valued at £526 billion.

Classes of Banks in the UK

The banks in the UK are categorized into several classes. The independent British retail banks in the UK are mainly the five banks discussed above. The banks in this category are quite a few since the banks in the UK are highly consolidated. The other class of banks is the banks that are incorporated into the UK. These are businesses that are considered banks by the Prudential Regulatory Authority. There are also consumer financial organizations and banks owned by foreign banks.

The Largest Banks in the United Kingdom

| Rank | Bank | Total Assets (In billions of British pounds) |

|---|---|---|

| 1 | HSBC Holdings | 1,936 |

| 2 | Lloyds Banking Group | 817 |

| 3 | Royal Bank of Scotland Group | 783 |

| 4 | Barclays | 1,203 |

| 5 | Standard Chartered | 526 |