What Are the Economic Implications of Brexit?

What Is Brexit?

Brexit is a term used to describe the decision by the United Kingdom to exit the European Union (EU). This decision was arrived at after a referendum was held in the UK on June 23, 2016. Shortly after, on March 29, 2017, article 50 of the Treaty of the EU was invoked and the exit process began.

Consequences of Brexit on the UK Economy

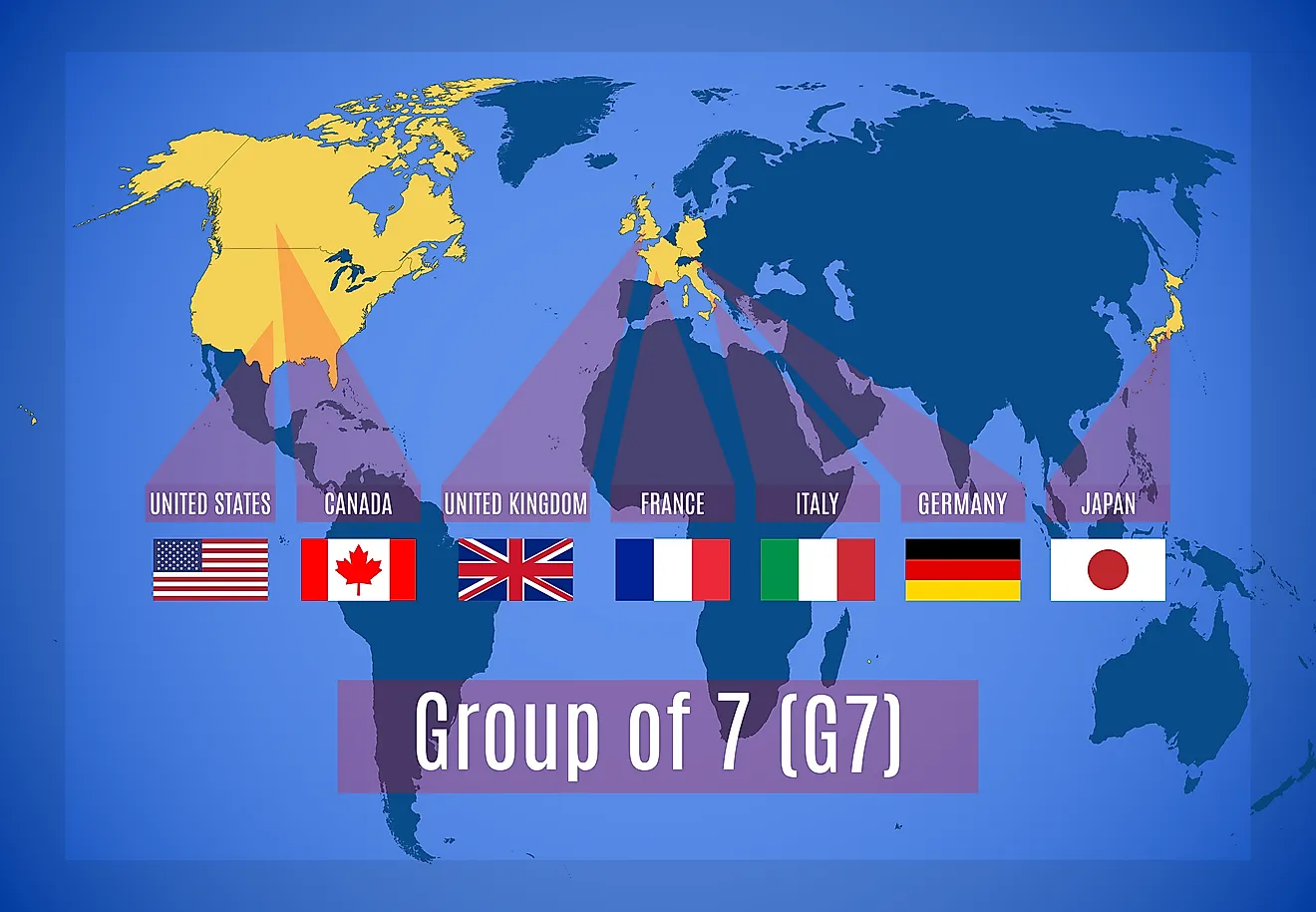

One of the most visible and widely agreed upon fact is that the UK economy has been negatively affected by Brexit. For example, in November 2017, interest rates were raised by the Bank of England. The bank had not raised the rates for over a decade. In fact, experts speculate that the interest rate will increase even further before the end of 2020. The fact that wage growth in the UK seems stagnant, times will be even harder. Further, the exit saw the UK among the least performing country in the G7 in 2017 after it was among the best before the 2016 referendum.

The UK’s economy had to be boosted by spending an extra £25 billion. More data also shows that this will present even bigger financial challenges to families compared to the financial problems experienced in the 1950s. Speculations into the future UK economy prior to the referendum placed the growth of the economy at around 2%. After the growth, the estimates decreased to 1.5%.

Indeed, data from other sources confirm these projections. For example, RAND Europe’s research shows that the UK, under the most realistic scenarios, would be worse off after completing the exit. While the research did not provide exact values, immediate consequences could be observed. Aside from the already discussed negative outcomes, the sterling pound became weaker in relation to the dollar. Business investments are also set to decrease by approximately 25% by 2019 compared to the period before the referendum.

The research by RAND also shows that the UK is not wise by exiting the EU while it has not set in place a favorable agreement for trading with the EU after exit. If the UK will not have reached an agreement with the EU by the time the exit is concluded, then the World Trade Organization’s rules apply. Under those rules, UK’s economy will lose around $140 billion ten years after the exit. This scenario is one of eight scenarios studied by the research. The seven remaining scenarios are all more favorable than the WTO option but the UK’s economy still loses and concludes that the UK is best protected if there is a post-Brexit trading agreement.

Consequences of Brexit on Business Sectors in the UK

The immediate negative effects are felt in specific sectors. The banking sector in the UK was approximated that it will lose at least 10,000 jobs after one day of the exit. Major financial groups also plan on relocating. Other sectors to be affected include construction and manufacturing, technology, food, and drinks industry will shrink, pharmaceuticals, architecture and design, and many other sectors.