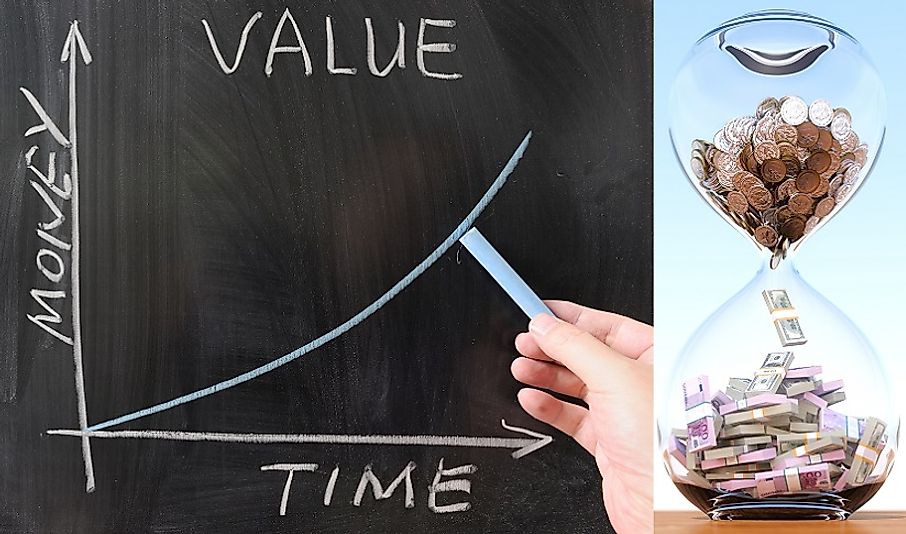

What Is The Time Value Of Money?

The time value of money, also known as the present discounted value, is the idea that a given quantity of money at present is of greater benefit and worth now than the same nominal quantity will be valued in the future. This principle stipulates that provided money can earn interest, any amount of money is worth more sooner it is received. The principle of time value of money explains that interest rates are paid or earned on either bank deposits or debt as a compensation for the time value of money. In addition to that, investors are willing to forgo spending their money if they expect a favorable return on their investment, a principle founded on the time preference.

Historical Views on the Time Value of Money

The time value of money was first conceptualized by Martin de Azpilcueta, a prominent 16th Century economist and religious scholar in the school of Salamanca. He argued that money exchange is not unnatural as it puts money on the same level as any other merchandise. He also highlighted that the morality for the exchanges did not depend on money as their object but the equitable exchanges.

Relevant Applications and Evolution Over Time

The principle of the time value of money allows the valuation of a likely stream of income in the future by discounting the annual revenues and adding them back together. The value attained is the present value (current worth of a future sum of the cash flow, given a specified rate of return) of the income stream. For this reason, given an amount of money, a person would prefer to get it now than in the future. The time value of money is mainly based on the present value, the future value (value of an asset or an amount of money at a specified date in the future). There are several formulas used in the calculation of either the present or the future values of money. These estimates are helpful in decision-making pertaining investments or borrowing of loans.

Praises and Criticisms of the Time Value of Money Concept

There are several criticisms of this principle. These include those by adherents to the Islamic school of economists, who claim that, due to inflation and deflation, there is a loss of the purchasing power in the future, and thus a provisioning of compensation to make up for such prospective losses is often needed. Deflation leads to a negative time value of money. Secondly, present consumption of a commodity or the present utility given by a good is more preferred than a postponed one. In as much as the prices and the amount of commodities did not change, a postponed utility needs compensation. Islamic laws only recognize two functions of money, namely that money is used as a measure of prices and that money is also used as a means of payment. Therefore money as a store of value is not recognized. Praises, however, have witnessed worldwide as an important mathematical tool which helps the general public to understand the concepts underlying it. Various investment decisions have been made based on the facts provided by this principle like the calculation of the future value of money can be determined easily once an internal rate of return is given. If the results are favorable, investments are made.