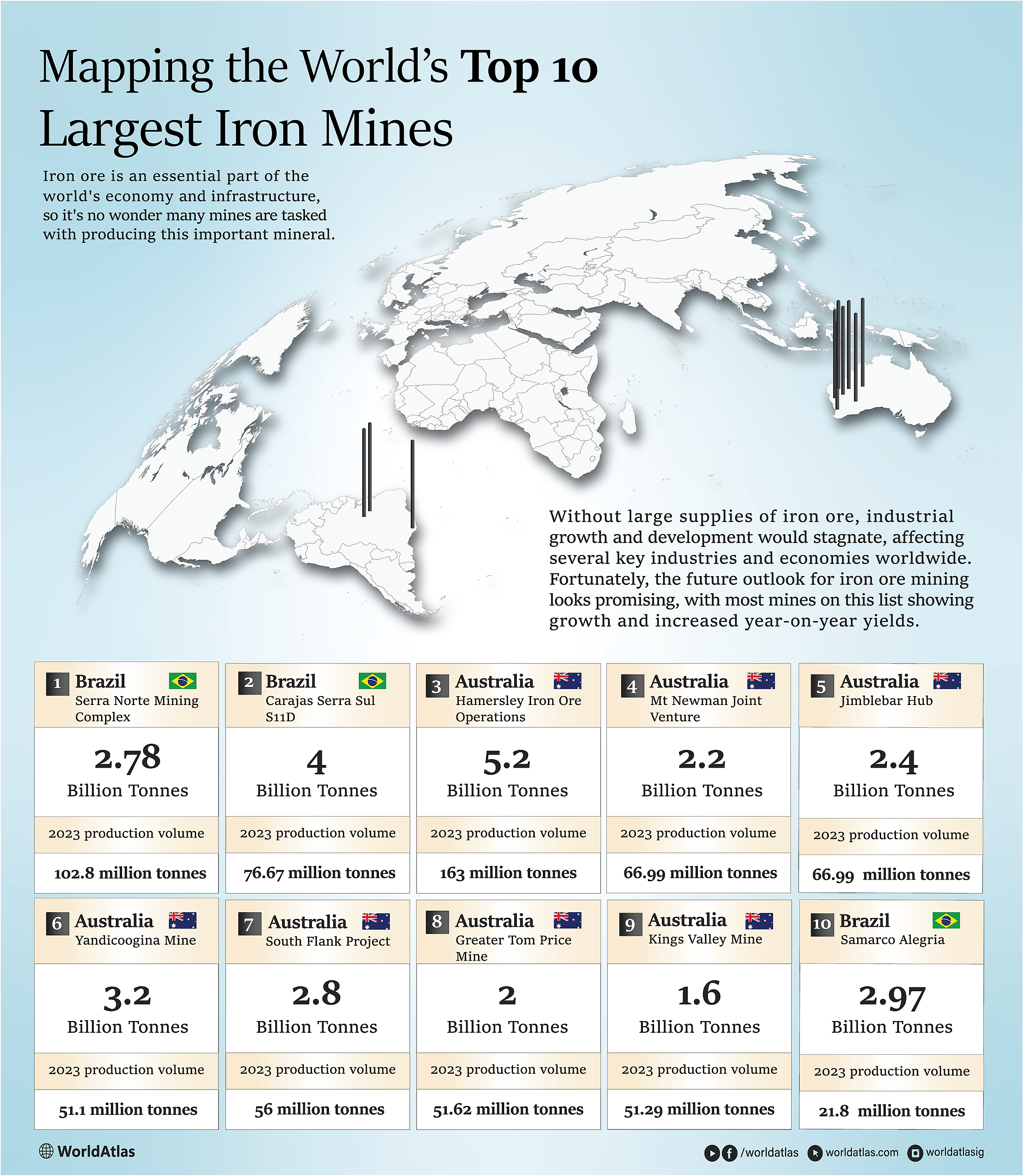

The 10 Largest Iron Mines In The World

Global data has revealed that over 922 iron ore mines are operational worldwide. Iron is indispensable in manufacturing and construction because it is the primary component of steel production. Iron ore is a mineral that significantly contributes to enhancing infrastructure and economic growth on a global scale.

Iron ore is produced annually in billions of tons, supporting the development of transportation systems, bridges, and other structures. Additionally, iron production is crucial for creating household appliances and numerous modern technologies and products. None of these structural and technological creations would be possible without iron ore. This article discusses ten of the largest iron mines in the world, along with crucial information on the mine itself, its production, reserve estimates, and significance.

Serra Norte Mining Complex

Located in Pará, Brazil, and owned by the huge mining corporation Vale, the Serra Norte Mining Complex mine produces high-grade ore. This mine is considered one of Vale's key assets within the company's portfolio and, thanks to mining operations like the Serra Norte Mining Complex Vale, is considered one of Brazil's second-most valuable companies in market capitalization.

The Serra Norte Mining Complex has faced typical challenges within the mining industry, such as meeting environmental regulations and absorbing hits from market fluctuations. Still, it continues to drive the social and economic development of Brazil.

The mine is estimated to be operational until 2038, and reports state that in 2023, its yearly production volume was 102.8 million tonnes. In the last few years, the mine has maintained a regular high production rate with a minor yearly increase from year to year, but updated reserve estimates have not yet been revealed. However, as of the last recorded count, it is 2.78 billion tonnes, helping cinch the mine's position as the top supplier of iron ore.

Carajas Serra Sul S11D

Carajas Serra Sul S11D is another large mine owned by Vale in Pará, Brazil. It is expected to be operational until 2059 and is considered the largest greenfield project in the industry's iron ore mining sector. With its stable production each year, there are rumors that the mine will expand in the coming years.

Since starting production in December 2016, the Carajas Serra Sul S11D mine has become another critical asset to Vale's portfolio. With expansion and improved production, its future is looking bright. This is a reassurance to Vale, considering the Carajas Serra SUL S11D mine expansion required a total investment of $19.67 billion.

The reserve estimate is about 4 billion tonnes, and the yearly production volume in 2023 was 76.67 million tonnes. This open-pit mine supplies not only iron ore but also other essential minerals such as copper, gold, nickel, manganese, and bauxite.

Hamersley Iron Ore Operations

Rio Tinto owns the Hamersley Iron Ore mine, one of the oldest mining operations globally. Tinto's Hamersley operations began in the 1960s. It is located in Western Australia and has an annual production volume of 163 million tonnes as of 2023. When added to Rio Tinto’s total iron ore production in Pilbara, the production volume increases to a whopping 324 million tonnes.

The reserve estimate for this mine is 5.2 billion tonnes, and it produces iron ore steadily annually. Ongoing investments are being made to improve its infrastructure, helping it continue to play a huge role in supplying high-end quality iron ore worldwide.

This mine is a massive asset in Rio Tinto's portfolio. It holds historical significance in being Australia's number one supplier of exporting and supplying iron ore, which has considerably impacted the country's economic growth over the years.

Mt Newman Joint Venture

The Mt Newman Joint Venture mine, is another mine in Western Australia that has influenced the Australian economy. The BHP Group (Broken Hill Proprietary Group) owns the mine, which, according to 2023 estimates, produces around 66.99 million tonnes yearly.

The mine is predicted to be open until 2052 and holds reserve estimates of 2.2 billion tonnes. This mine has been a pivotal contributor to output since the 1960s and has become the critical cornerstone of the iron ore operations under BHP.

Since taking over the Mt Newman Joint Venture mine, it has grown to be one of the largest companies in Australia. While the mine struggles with high employee turnover rates, its output is stable enough to continue meeting its production goals, and this continues to attract a skilled workforce.

Jimblebar Hub

The Jimblebar Hub mine is located in Western Australia, approximately 25 miles east of Newman, and is run by the BHP Group, which owns 85 percent of the mine, with Mitsui and ITOCHU owning the rest. Opened in 1989, it was initially named after prospector Ken McCamey and then McCamey's Monster until it was renamed Jimblebar Hub mine when BHP bought it in 1992.

The mine remained closed for many years until it was brought back to life in 2014 after a $3.6 billion investment. Current stats place this mine's reserves at 2.4 billion tonnes and its annual production volume at 66.99 million tonnes. Thanks to a recent increase in production capacity, it is expected to be continuously operational until 2052.

Yandicoogina Mine

Found in Western Australia and owned by the successful mining company Rio Tinto, the Yandicoogina Mine can boast an estimated 51.1 million tonnes of annual iron ore production, and it is known to have a reserve of 3.2 billion tonnes. This mine started operating in 1998 and has since produced impressive stats in terms of production year over year.

Currently, the mine is expected to have long-term plans to continue operating, but it is unknown when it will stop being operational. After a period of producing poor-quality iron ore, the mine has recently produced high amounts of quality ore.

Additionally, Rio Tinto's leadership is working towards improving industry production standards. Hence, the mine will likely continue producing higher-quality iron ore than specific industry competitors.

South Flank Project

Another contributor to BHP's portfolio is the South Flank Project mine, which is also in Western Australia. The mine produces 56 million tonnes yearly and has a reserve estimate of 2.8 billion tonnes. It is expected to operate until 2047.

Interestingly, the South Flank Project has been making waves recently because of its commitment to breaking gender barriers in the mining industry. It is doing this by setting gender equity targets and creating entry-level roles that allow the mine to hire women from diverse backgrounds and teach them the skills and knowledge they need to thrive in a mining career.

The mine has also been recognized for improving sustainable mining practices and has gained accolades for improving the local community's infrastructure.

Greater Tom Price Mine

Rio Tinto owns the Greater Tom Price Mine, located below the impressive Mount Nameless (Jarndunmunha) in Western Australia's Pilbara region, which is known for its mining expeditions. As one of Rio Tinto’s top iron ore mines, it's unsurprising that it is expected to remain operational until 2035. According to recent data, this mine has an annual production volume of 51.62 million tonnes and a reserve estimate of 2 billion tonnes.

The Greater Tom Price Mine has a rich history of improving the global iron market. However, the mine faces water and dust management concerns and is battling to appease the local communities. Yet, despite these concerns, the mine proves to have steady production with occasional increases from year to year.

Kings Valley Mine

Owned by FMG (Fortescue Metals Group), the Kings Valley Mine is 37 miles north of Tom Price in the Pilbara region of Western Australia. Compared to most on this list, it is a reasonably young mine, having first opened in 2014. The mine is essential to FMGs portfolio as it is responsible for the company's gradual ascension as one of the biggest iron ore suppliers globally.

In 2023, the Kings Valley Mine put out 51.29 million tonnes yearly production volume and 1.6 billion tonnes in reserve estimates. However, the rapid rise in the industry has seen the company struggling with its workforce and meeting environmental regulations. The Fortescue Metals Group plans to develop the Kings Valley Mine further because it continues to show steady production growth year over year.

Samarco Alegria

Samarco Alegria mine is considered a joint project between powerhouse companies Vale and BHP. This mine is most known for its environmental disaster when the collapse of the Fundão tailings dam, which belonged to Samarco, occurred. Before the dam failure in 2015, the mine produced 21.8 million tonnes and had a reserve estimate of 2.97 billion tonnes.

Due to this problem, the mine has halted, but it is recovering, which is why it has made it onto this top-ten list. Since the disaster, partial operations have resumed post-reconstruction, but estimates of its new yearly production are unknown.

Despite its challenges, Samarco Alegria mine has shown resilience and is a leading example of the importance of sustainable practices. The mine aims to return to full recovery for a more sustainable and profitable future.

What Is The Geographical Distribution Of Top Iron Mines

Australia and Brazil have the highest percentage of iron ore reserves and are the largest producers. Since 2022, Brazil has held about 34 billion metric tons of iron content in its reserves, while Australia holds the largest reserves with 48 billion metric tonnes.

Additionally, Australia exports 20% of iron ore, accounting for one of the highest exports of this mineral worldwide. These two countries hold the highest geographical distribution of high-producing iron ore mines globally.

What Are The Challenges Faced In Iron Mining

Iron ore mining is essential, but the industry often faces significant challenges. The most common of these is complying with environmental regulations that require costly technology, practices, investments, and operational expenses. Additionally, the industry grapples with obtaining mining permits, resolving land rights disputes, and managing complex supply chains.

The iron mining industry also faces significant challenges with labor disputes, skill gaps, and workforce challenges.

Moreover, many iron ore mining companies also face difficulties surrounding concerns about how their mines impact local communities and how they are maintaining positive relationship efforts.

Furthermore, infrastructure is a concern and a challenge, especially with existing transport, such as ports and railways, which are struggling to keep up.

Technological Advancements and Future Outlook for The Iron Industry

The iron ore industry is experiencing several technological advancements, the most impressive of which is the adaptation of EAFs (electric arc furnaces). These are energy-efficient and flexible compared to blast furnaces and are made with scrap metal, which lowers carbon emissions.

AI and automation have also equipped factories to predict maintenance needs and improve safety using sensors and data analytics. Introducing AI to control systems has proven to ensure high product quality and reduce waste in the iron ore industry.

In addition, hydrogen-based direct reduction is set to provide a sustainable method that uses hydrogen instead of carbon to produce iron, which is good for reducing greenhouse gas emissions. Hydrogen-based direct reduction has not yet been commercialized or widely adopted in the iron ore mining industry, but it could be in the near future.

Essentially, these advancements are helping the iron industry focus on creating renewable energy sources and reducing its environmental impact.

Conclusion

Iron ore is an essential part of the world's economy and infrastructure, so it's no wonder many mines are tasked with producing this important mineral. Without large supplies of iron ore, industrial growth and development would stagnate, affecting several key industries and economies worldwide. Fortunately, the future outlook for iron ore mining looks promising, with most mines on this list showing growth and increased year-on-year yields.