The Richest Countries In Europe

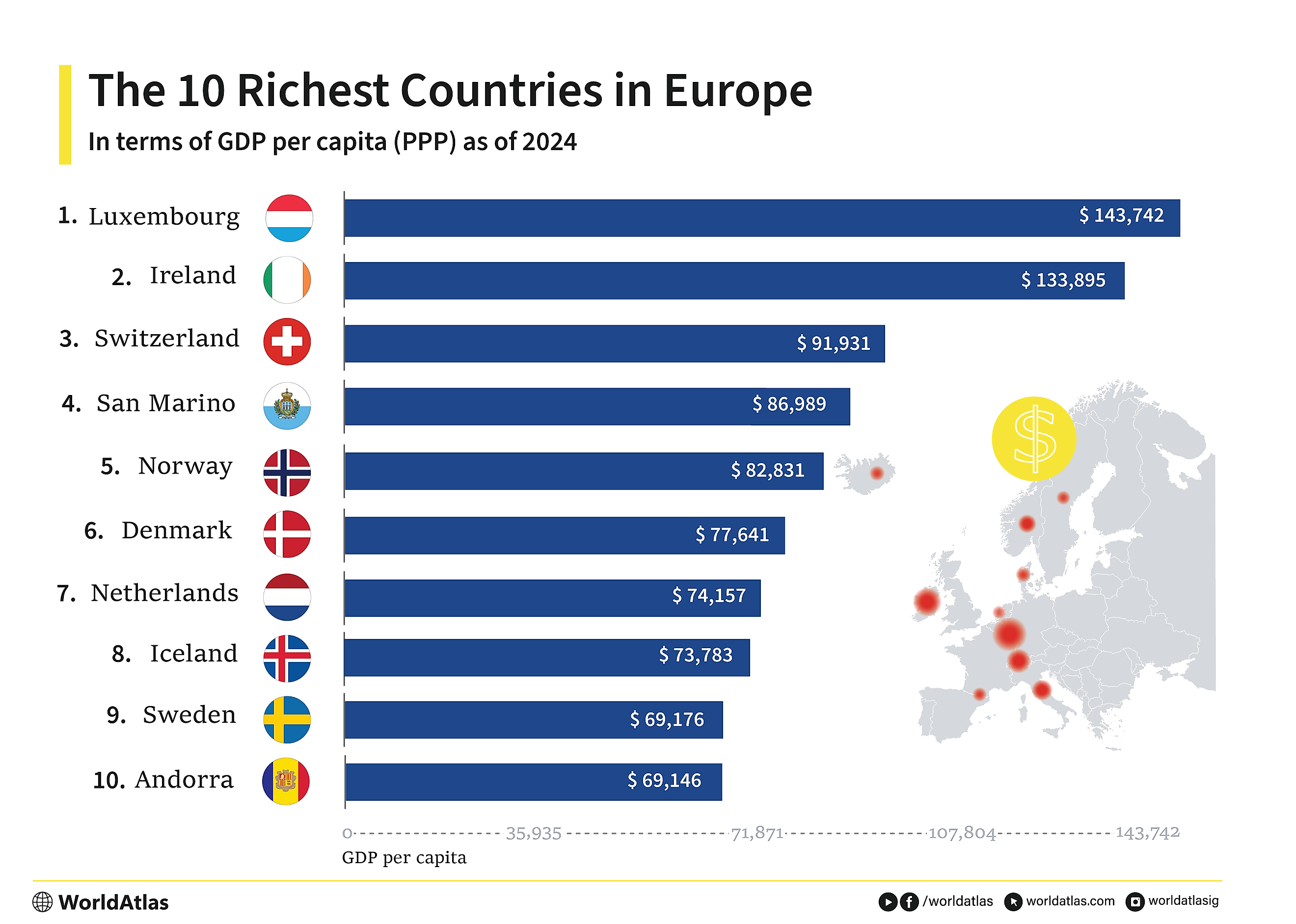

Europe is home to some of the most affluent and innovative economies in the world, each shaped by its unique geography, history, and policy choices. From global financial centers to resource-rich Nordic nations, the continent’s wealthiest countries consistently lead in terms of GDP per capita (PPP). Many of these states are relatively small in size or population, yet they rank among the world’s economic powerhouses thanks to strategic economic policies, diversification, and international trade.

Below is a closer look at the ten richest European countries by GDP per capita (PPP) projected for 2025. You’ll see recurring themes such as specialized industries (financial services, pharmaceuticals, technology), strong welfare systems, robust infrastructure, and innovation-driven approaches to sustain growth. This year, Luxembourg, Ireland, and Norway rank as the three richest countries in Europe with a GDP/Capita in PPP of $154,914, $131,548, and $106,540, respectively.

Let’s begin with tiny Luxembourg, whose extraordinary GDP per capita far outstrips larger economies, illustrating how a strategic location, a thriving financial sector, and a flexible economic model can secure a top spot in Europe’s richest list.

10 Richest Countries In Europe

| Rank | Country | GDP/Capita (PPP) |

|---|---|---|

| 1 | Luxembourg | $154,914.92 |

| 2 | Ireland | $131,548.38 |

| 3 | Norway | $106,540.416 |

| 4 | Switzerland | $98,144.794 |

| 5 | Denmark | $85,788.768 |

| 6 | Netherlands | $83,822.682 |

| 7 | San Marino | $82,578.756 |

| 8 | Iceland | $80,318.312 |

| 9 | Malta | $75,821.658 |

| 10 | Belgium | $75,187.071 |

Jump to the list of all European countries ranked by GDP/Capita (PPP)

1. Luxembourg - $154,914 GDP/Capita (PPP)

Luxembourg is projected to remain Europe's richest country in 2025, with an exceptional GDP per capita of approximately $154,914 (PPP). Its economy, largely driven by services (80.6%), particularly the financial sector, positions Luxembourg as a key international banking and investment hub.

Historically reliant on steel, Luxembourg transitioned to financial services, leveraging favorable tax laws and banking secrecy, although recent reforms have enhanced transparency and compliance with EU standards. With unemployment modest at 5.9%, Luxembourg enjoys a high employment rate and substantial average net monthly salaries of about $4,422. Its economic strength is reflected in an AAA credit rating from all major agencies and minimal public debt at just 15% of GDP.

Luxembourg's advanced telecommunications sector includes SES, the world’s largest satellite operator. Additionally, it pioneers the space resource extraction industry by implementing innovative legal frameworks for asteroid mining. Despite economic resilience, 21.4% of its population remains at risk of poverty or exclusion, reflecting ongoing socioeconomic disparities in one of Europe's wealthiest states.

2. Ireland - $131,548 GDP/Capita (PPP)

In 2025, Ireland ranks as the second richest country in Europe, with a GDP per capita of approximately $131,548 (PPP). Its highly developed knowledge-based economy thrives on high-tech industries, pharmaceuticals, software, financial services, and agribusiness.

The country ranks first globally in attracting high-value foreign direct investment, largely due to favorable tax conditions, although recent international reforms have challenged its tax model. The distortion of economic data by multinational tax practices led to the creation of a modified Gross National Income (GNI) metric for accurate economic assessment. Multinationals, primarily from the US, significantly influence the economy, contributing heavily to employment, taxes, and exports.

Ireland's openness to global markets continues to support strong exports in pharmaceuticals and technology products. Despite robust economic growth, Ireland maintains relatively low public debt (44.7% of GDP) and has a positive budget balance. Challenges remain, including housing shortages and economic disparities, with 19.2% of the population at risk of poverty or exclusion.

3. Norway - $106,540 GDP/Capita (PPP)

Norway maintains a robust mixed economy marked by significant state ownership in strategic sectors like oil and natural gas, contributing to a GDP of $506.47 billion nominally and $597.42 billion PPP. Its GDP per capita stands impressively at $90,320 nominally and $106,540 PPP, securing high ranks of 4th and 3rd in Europe, respectively. The economy is diversified across agriculture (1.6%), industry (34.7%), and services (63.5%), reflecting a balanced economic structure.

Despite a global economic sensitivity, Norway's economy demonstrates resilience and prudent management, evident from a government surplus and a stable AAA credit rating. The nation benefits enormously from its natural resources, particularly North Sea oil, which supports its extensive welfare system and contributes to a low Gini coefficient of 24.7, indicating low income inequality.

Norway's strategic economic decisions include not joining the EU but maintaining access to its markets through agreements like the EFTA and EEA. This arrangement supports its export-oriented economy, with significant exports including petroleum products, machinery, and seafood, primarily to the UK and Germany.

Investments from oil revenue are channeled into the Government Pension Fund Global, illustrating a long-term strategy for wealth management. The fund's capital is restricted for use in public spending, ensuring fiscal sustainability.

4. Switzerland - $98,144 GDP/Capita (PPP)

Switzerland, in 2025, stands as one of Europe's wealthiest nations, not only due to its established banking sector and favorable tax system but primarily through continuous innovation and economic stability. The country has a remarkable wealth, with assets averaging CHF 460,000 per resident, and is home to 800,000 millionaires, representing 1.7% of the global 1% wealthiest despite having just 0.1% of the world population. This concentration of wealth is reflected in its status as housing 40 of the world’s billionaires.

The roots of Switzerland’s prosperity extend beyond banking; it encompasses a history of industrialization and innovation, particularly in high-value sectors like pharmaceuticals, machinery, and chemicals. The country’s strategic practice of neutrality has spared it from economic ravages of wars, contributing to its political and economic stability which attracts wealthy individuals and investors seeking a safe financial haven.

Furthermore, Switzerland's financial landscape is significantly shaped by its sophisticated banking and finance sector, which has evolved with stricter regulations to maintain its global standing. The country also benefits from a unique inheritance tax system favoring wealth accumulation and retention among its richest.

5. Denmark - $85,788 GDP/Capita (PPP)

Denmark enjoys a highly developed, modern mixed economy dominated by the service sector, which employs 80% of the workforce. The country’s GDP is projected to reach $431.23 billion, with a notable per capita income of $71,978. Denmark's success stems from its robust social security system, efficient governance, and adherence to the Nordic model, marked by high taxes funding extensive public services such as healthcare, education, and childcare. Denmark’s fiscal policy is considered sustainable, with government debt remaining low and a consistently positive current account balance.

The country maintains economic stability through its fixed exchange-rate system, pegging the Danish krone to the euro, while emphasizing labor market flexibility and high employment rates. Key industries include pharmaceuticals, renewable energy (especially wind turbines), shipbuilding, medical equipment, and food processing.

6. Netherlands - $83,822 GDP/Capita (PPP)

The Netherlands economy has long been prosperous and innovative, driven by trade, logistics, high-tech industries, and renewable energy. With a nominal GDP of $1.27 trillion and a per capita income of $70,606, it is Europe's fifth-largest economy. Amsterdam hosts European headquarters for global tech giants like Google, Microsoft, and Netflix, while Rotterdam remains Europe's largest seaport, emphasizing the country's strength in logistics and commerce.

The Dutch economy is characterized by high productivity, stable industrial relations, low unemployment, and a substantial current account surplus. Although agriculture employs only around 2% of the workforce, the highly mechanized sector produces significant exports. Historically dependent on natural gas from the Groningen fields, the Netherlands has shifted towards sustainability, aiming for a fossil-fuel-free future by 2050.

As an influential tax conduit nation, the Netherlands continues attracting substantial foreign direct investment, reinforcing its status as a key European economic hub.

7. San Marino - $82,578 GDP/Capita (PPP)

In 2025, San Marino remains among Europe's wealthiest microstates, with a developed, free-market economy heavily reliant on tourism, banking, and manufacturing, particularly ceramics, clothing, furniture, and wine. Despite a GDP per capita PPP approaching $83,000, similar to northern Italy, the economy faces vulnerabilities, especially in banking.

After severe setbacks from the 2008 recession, San Marino's banking sector continues to struggle with non-performing loans surpassing GDP. Recent reforms ending banking secrecy and anonymous companies have helped restore international credibility, removing the country from tax haven blacklists. Though agriculture contributes marginally to GDP, San Marino exports collectible stamps and limited-edition Euro coins, generating substantial revenue from tourism and collectors. Dependent on Italy for essential imports like energy, food, and water, San Marino maintains a customs union with the EU and uses the Euro. Public finances weakened significantly post-crisis, with government debt now notably higher, reflecting ongoing economic adjustments.

8. Iceland - $80,318 GDP/Capita (PPP)

In the 1990s, Iceland underwent significant free market reforms, including market liberalization, deregulation, and privatization aimed at modernizing its economy. Key measures included the abolition of the net wealth tax, slashing capital and corporate tax rates, ending subsidies for unprofitable firms, and privatizing state-owned enterprises. These changes spurred the transformation of Iceland’s economy from fishing to finance-driven, with the banking sector growing to account for 96% of GDP by 2008.

However, the 2008 financial crisis devastated Iceland's economy, leading to the collapse of its banking sector and widespread bankruptcy. Unlike other countries, Iceland let its banks fail, nationalized them, and initiated widespread debt forgiveness for its citizens. It also allowed its currency to devalue significantly to boost demand for local products internationally and took the unique step of prosecuting responsible bankers.

Post-crisis, Iceland prioritized stabilizing its economy and safeguarding citizens' wellbeing over conventional economic metrics. This approach led to substantial reforms, including efforts to rewrite the constitution through a participatory process, though the new draft was not ultimately adopted. Recent policies have focused on gender equality and well-being, moving away from traditional economic measures towards a wellbeing-oriented economic strategy and incorporating well-being indicators into policy assessments to enhance quality of life. These efforts reflect Iceland's shift towards a more sustainable and equitable economic model, highlighted by its membership in the Wellbeing Economy Government's partnership.

9. Malta - $75,821 GDP/Capita (PPP)

The economy of Malta, a highly industrialized service-based economy, stands robust within the EU. Classified by the International Monetary Fund as advanced and recognized as high-income by the World Bank, Malta is an innovation-driven economy. It benefits significantly from its strategic Mediterranean location, acting as a crossroads between Europe, North Africa, and the Middle East. Key economic sectors include foreign trade, manufacturing, especially in electronics, and services like finance and ICT, supported by a multilingual, English-speaking workforce and a productive labor force. The nation's open market economy is complemented by low corporate taxes, attracting considerable business activity.

Tourism is a vital component of the economy, with Malta attracting over 1.7 million tourists in 2014. The country maintains sound fiscal health with a government debt to GDP ratio that remains manageable. Malta’s infrastructure includes Luqa International Airport and two major ports, which significantly contribute to its economic activities. Historical shifts from a trade-focused economy during the Napoleonic Wars to a modern diversified economy highlight Malta's adaptive economic strategies over the centuries.

10. Belgium - $75,187 GDP/Capita (PPP)

Belgium is a prosperous, high-income nation boasting a diverse, well-developed economy. Positioned strategically in central Europe, it has leveraged its excellent transport infrastructure, especially the Port of Antwerp, to become a critical hub for international trade.

Belgium's economy is heavily service-oriented, accounting for approximately 77% of GDP, with robust sectors in finance, telecommunications, and logistics. Historically, Belgium was among Europe's first industrialized countries; today, manufacturing remains essential, particularly in chemicals, automotive, and high-tech industries. Economic activity is regionally distinct: Flanders leads in productivity, innovation, and employment, benefiting from investments in high-tech and multinational corporations, while Wallonia has transitioned from traditional steel and coal industries toward aerospace, biotechnology, and logistics, albeit facing higher unemployment. Brussels serves as Europe's administrative heart, hosting numerous EU institutions and multinationals, thus contributing significantly to GDP per capita, though with marked unemployment. Despite these strengths, Belgium faces substantial public debt (108% of GDP in 2021) but maintains stability through high domestic savings and a robust social security system.

Europe’s richest economies highlight how strategic policies, advanced industries, and robust welfare systems can foster exceptional living standards and steady growth. Despite varying sizes and populations, these countries share diverse exports, innovation-driven strategies, and prudent governance. Their success underscores the importance of openness, adaptability, and long-term planning. By leveraging globalization and ensuring fiscal stability, Europe’s top performers remain resilient powerhouses, showcasing the continent’s ongoing leadership in global economic competitiveness today.

Countries In Europe Ranked By GDP/Capita in PPP

| Rank | Country | GDP/Capita (PPP) |

|---|---|---|

| - | Liechtenstein | no data |

| - | Monaco | no data |

| 1 | Ireland | $131,548.38 |

| 2 | Norway | $106,540.42 |

| 3 | Switzerland | $98,144.79 |

| 4 | Denmark | $85,788.768 |

| 5 | Netherlands | $83,822.682 |

| 6 | San Marino | $82,578.756 |

| 7 | Iceland | $80,318.312 |

| 8 | Malta | $75,821.658 |

| 9 | Belgium | $75,187.071 |

| 10 | Austria | $74,975.643 |

| 11 | Sweden | $74,143.057 |

| 12 | Germany | $72,660.471 |

| 13 | Andorra | $69,597.088 |

| 14 | France | $67,657.609 |

| 15 | Finland | $67,073.815 |

| 16 | United Kingdom | $64,384.271 |

| 17 | Italy | $62,603.046 |

| 18 | Czech Republic | $59,205.196 |

| 19 | Slovenia | $58,153.252 |

| 20 | Spain | $56,659.487 |

| 21 | Lithuania | $55,995.397 |

| 22 | Poland | $54,497.596 |

| 23 | Portugal | $51,256.666 |

| 24 | Croatia | $51,223.926 |

| 25 | Romania | $49,943.598 |

| 26 | Estonia | $49,696.506 |

| 27 | Hungary | $49,147.382 |

| 28 | Russian Federation | $48,956.824 |

| 29 | Slovak Republic | $47,438.529 |

| 30 | Latvia | $45,447.109 |

| 31 | Greece | $43,800.613 |

| 32 | Bulgaria | $41,505.736 |

| 33 | Montenegro | $33,620.151 |

| 34 | Belarus | $33,602.546 |

| 35 | Serbia | $30,908.809 |

| 36 | North Macedonia | $28,720.333 |

| 37 | Albania | $22,729.717 |

| 38 | Bosnia and Herzegovina | $22,610.557 |

| 39 | Ukraine | $20,756.791 |

| 40 | Moldova | $19,909.457 |

Discover More Rich Countries

The Richest Countries In The World

Luxembourg, Singapore, and Ireland stand out as the richest countries for 2025, with GDP/Capita in PPP of $154,910, $153,610, and $131,550, respectively.

The Richest Countries In Asia

Singapore, Qatar, and Brunei are currently the richest countries in Asia for 2025, with GDP/Capita in PPP of $153,610, $118,760, and $95,040, respectively.

The Richest Countries In North America

The United States, Canada, and Panama are the richest countries in North America for 2025, with GDP/Capita in PPP of $89,680, $64,570, and $42,770, respectively.

The Richest Countries In South America

Guyana, Uruguay, and Chile are the richest countries in South America for 2025, with GDP/Capita in PPP of $91,380, $36,010, and $34,790, respectively.

The Richest Countries In Africa

Seychelles, Mauritius, and Gabon are the richest countries in Africa for 2025, with GDP/Capita in PPP of $43,070, $33,950, and $24,680, respectively.

The Richest Countries In South Asia

The Maldives, Bhutan and India are the richest countries in South Asia for 2025, with GDP/Capita in PPP of $35,980, $18,110, and $11,940, respectively.