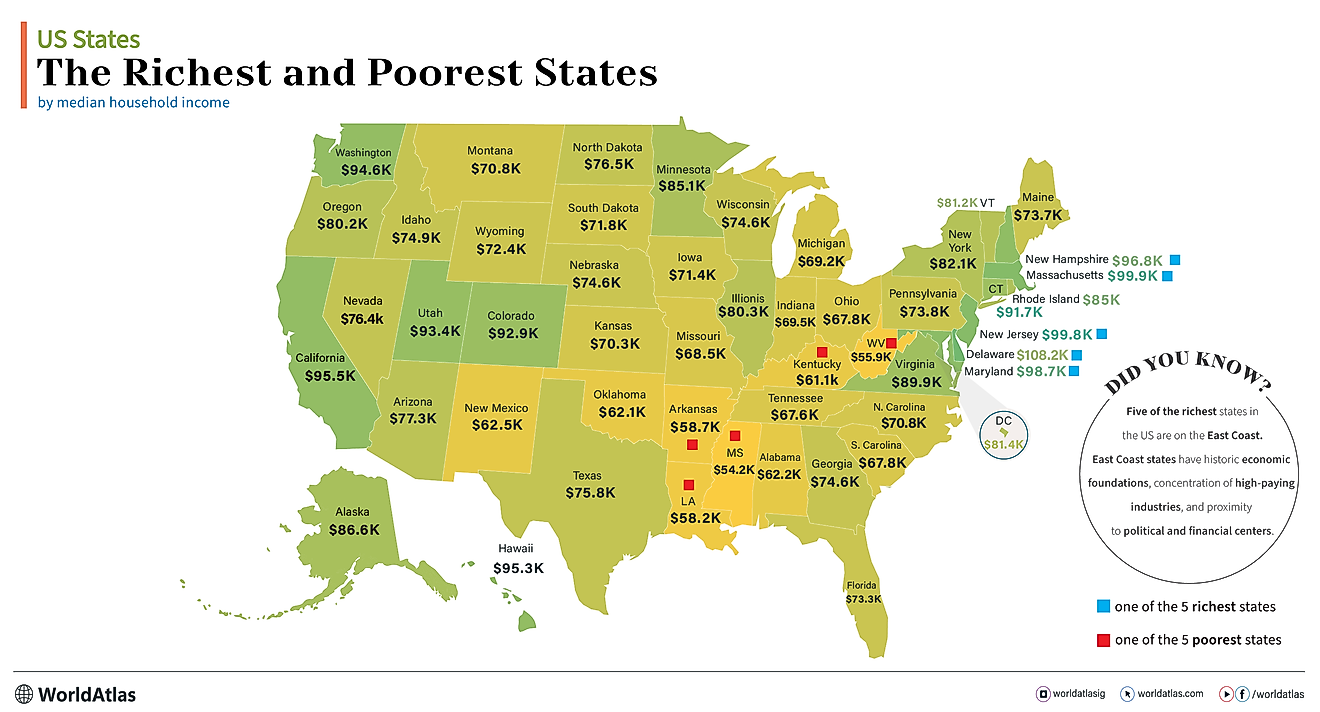

The 10 Worst States for Fiscal Stability

Fiscal Stability is of great importance in ensuring the success of programs and projects of the government. Weak fiscal health hampers service delivery since the economic strength of a state is unable to sustain development. Fiscal strength of a state can be measured either on the short or long-term basis. In the US, the major parameters for the long-term are the liability on public pension and government ratings in term of creditworthiness. Short-term fiscal rating is based on liquidity management and budget control. Below are the worst states in terms of Fiscal Stability.

Worst States for Fiscal Stability

Illinois

Illinois State is ranked as the worst performing in the fiscal stability index. In terms of short term and long term fiscal stability, the state is ranked 49th and 50th respectively. The major drivers are poor records on economic growth, lack of a balanced budget, and passing of non-budgetary reforms. Such fiscal weakness has led to slow personal income growth and job losses. The state is one of the weakest economies characterized by unpaid bills, interest penalties, and a decline in credit-worthiness.

New Jersey

Close scrutiny of the budget balancing, liquidity management, and long-term solvency indicates that New Jersey has taken the worst fiscal shape ever. Service level delivery and solvency of the trust fund has diminished in quality. The current status indicates higher liabilities than assets. Budgetary squabbles led to the New Jersey State government halting operations for a few weeks. Primary debts per capita have gone up making the state rank 50th in short-term fiscal stability and position 48 in long-term fiscal ratings.

Louisiana

Louisiana State is rated the third worst in terms of fiscal stability. A budget deficit led to temporary taxes which did not necessarily fill the hole in the budget. Despite strong political will to add fiscal strength, the budget committee has not been able to come up with any conclusive method of bridging the deficit through taxation. Job creation has neither increased in the manufacturing industries nor in the commercial sector.

Alaska

Although it is ranked 4th worst in overall fiscal stability, Alaska has made improvements in the short-term. This has led to a rating of position 16 but the long-term fiscal stability has been rated poorly at position 49. There are oil reserves in the state which contribute high income to the gross domestic income. This has led to Alaskans not paying sales tax and personal income tax which could have boosted the budget. When oil prices drop the revenue decreases making the state stretch a lot in trying to provide basic services. Despite citizens getting dividends from oil and having the second highest median in household income, the fiscal stability remains among the worst.

Kentucky

At position five, the Kentucky State is ranked 42nd and 47th in terms of short-term and long-term fiscal stability respectively. The worst grades in fiscal policy stability come from pension fund which is poorly managed and lowly funded. The stability is further weakened by low reserve funds. Budgetary forecasts and lack of multi-year expenditure estimates plus failure to allocate costs to the depreciation of infrastructure made the state score poorly.

What Can The States Do To Improve their Fiscal Stability?

To improve on the fiscal stability, a state should have an implementable fiscal framework. Well-designed strategies should be directed at managing public resources risks. Economic development and empowerment should be the priority. The states should look for alternative sources of income to meet budgetary requirements.

The 10 Worst States for Fiscal Stability

| Rank | State | Short-Term Fiscal Stability | Long-Term Fiscal Stability |

|---|---|---|---|

| 1 | Illinois | 49 | 50 |

| 2 | New Jersey | 50 | 48 |

| 3 | Louisiana | 47 | 42 |

| 4 | Alaska | 16 | 49 |

| 5 | Kentucky | 42 | 47 |

| 6 | Mississippi | 32 | 46 |

| 7 | New Mexico | 28 | 44 |

| 8 | California | 27 | 43 |

| 9 | Pennsylvania | 44 | 38 |

| 10 | Connecticut | 14 | 45 |